Not known Incorrect Statements About Eb5 Immigrant Investor Program

Table of ContentsThe Facts About Eb5 Immigrant Investor Program UncoveredEb5 Immigrant Investor Program for DummiesA Biased View of Eb5 Immigrant Investor ProgramEb5 Immigrant Investor Program - The FactsA Biased View of Eb5 Immigrant Investor ProgramThe 3-Minute Rule for Eb5 Immigrant Investor Program

In spite of being much less popular, various other paths to acquiring a Portugal Golden Visa consist of investments in equity capital or personal equity funds, existing or new organization entities, resources transfers, and donations to support clinical, technological, creative and social advancements. Holders of a Portuguese resident permit can additionally work and examine in the country without the need of acquiring added permits.

The Single Strategy To Use For Eb5 Immigrant Investor Program

Investors should have both a successful business history and a substantial service track document in order to apply. They might include their spouse and their kids under 21-years- old on their application for long-term home. Successful applicants will receive a renewable five-year reentry authorization, which allows for open traveling in and out of Singapore.

Fascination About Eb5 Immigrant Investor Program

Candidates can invest $400,000 in government authorized realty that is resalable after 5 years. Or they can invest $200,000 in government authorized property that is resalable after 7 years. All while paying government charges. Or they can contribute $150,000 to the federal government's Sustainable Development Fund and pay lower government fees.

This is the major advantage of immigrating to Switzerland contrasted to various other high tax obligation nations. In order to be qualified for the program, applicants should More than the age of 18 Not be utilized or occupied in Switzerland Not have Swiss citizenship, it must be their initial time residing in Switzerland Have rented or purchased home in Switzerland Give a long list of recognition records, including tidy criminal record and excellent ethical character It takes about after payment to obtain a resident license.

Rate 1 visa holders stay in status for about 3 years (depending upon where the application was submitted) and need to put on prolong their stay if they desire to proceed living in the UK - EB5 Immigrant Investor Program. Candidates must have personal assets that value at greater than 2 million and have 1 million of their own money in the U.K

9 Simple Techniques For Eb5 Immigrant Investor Program

The Rate 1 (Entrepreneur) Visa stands for 3 years and four months, with the choice to prolong the visa for an additional two years. The candidate might bring their reliant member of the family. When the entrepreneur has actually been find this in the United Kingdom for 5 years, they can look for indefinite entrust to remain.

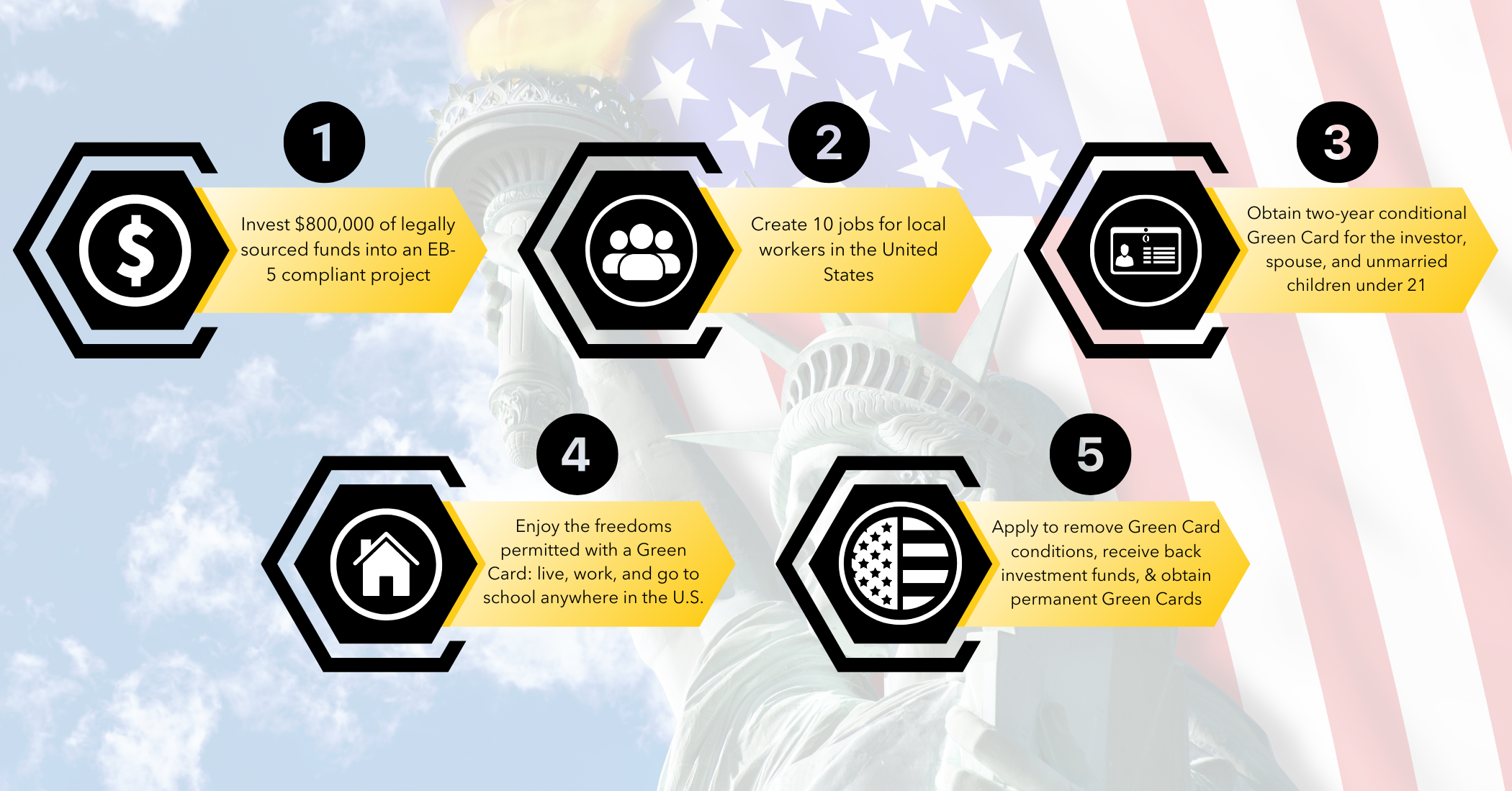

Investment immigration has actually been on an upward trend for greater than twenty years. The Immigrant Financier Program, likewise recognized as the EB-5 Visa Program, was developed by the U.S. Congress in 1990 under the Immigration Act of 1990 or IMMACT90. Its primary objective: to promote the united state economic climate via job production and capital expense by international financiers.

This included lowering the minimal investment from $1 million to $500,000. Over time, changes have enhanced the minimal investment to $800,000 in TEAs and $1.05 million in various other areas.

Eb5 Immigrant Investor Program Can Be Fun For Everyone

Visas are "reserved" each monetary year: 20% for rural, 10% for high joblessness, and 2% for facilities. Extra reserves carry over to the following year. Developers in country areas, high unemployment areas, and facilities jobs can benefit from a devoted pool check of visas. Financiers targeting these certain locations have an increased possibility of visa availability.

Capitalists now have the opportunity to spend in government-backed framework jobs. Financiers ought to be conscious of the approved kinds of financial investment funds and setups. Financiers and their families already legally in the United state and qualified for a visa number might simultaneously submit applications for change of condition along with or while awaiting adjudication of the investor's I-526 request.

This streamlines the process for financiers already in the U.S., expediting their capacity to change standing and preventing consular visa processing. Rural jobs receive concern in USCIS handling. This encourages designers to initiate jobs in backwoods because of the faster handling times. Financiers seeking a quicker processing time may be a lot more inclined to buy rural jobs.

Rumored Buzz on Eb5 Immigrant Investor Program

Trying to find united state federal government information and solutions?

To certify, applicants must spend in brand-new or at-risk business business and produce full time positions for 10 certifying staff members. The United state economic climate benefits most when a place is at danger and the new financier can supply a functioning facility with complete time tasks.

TEAs were carried out into the financier visa program to encourage investing in places with the best requirement. TEAs can be backwoods or areas that experience high unemployment. A backwoods is: outside of conventional city analytical locations (MSA), which is a city and the surrounding locations within the external limit of a city or town with a populace of 20,000 or even more A high unemployment area: has experienced joblessness of at the very least 150% of the nationwide great post to read average price An EB-5 regional facility can be a public or private economic device that advertises financial development.